With equity and fixed income markets both in turmoil, floating rate credit has once again delivered exceptional results for investors.

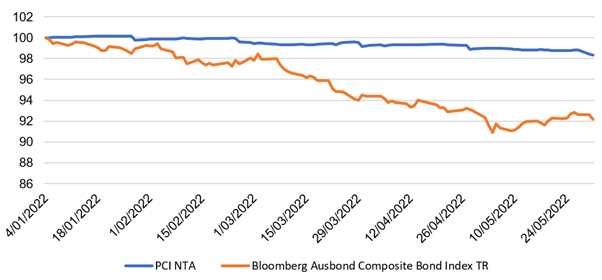

Absolute returns of the Perpetual Credit Income Trust (PCI) portfolio over the 1 month, 3 months and 1 year to 30 April 2022 were +0.1%, +0.3% and +2.4% respectively. These returns reflect very favourably against the official benchmark of the portfolio, which is the RBA Cash Rate benchmark, but they also compare exceptionally well against the Bloomberg AusBond Composite Index, which is down -1.49%, -6.33% and -7.47% over the same periods. Fixed rate bonds have endured a torrid run with the Bloomberg global and Ausbond Composites posting their worst ever start to year. Allocation to floating rate credit during this time has been well rewarded. The below chart compares the value of the Trust’s assets (The NTA) against the index level of the Bloomberg Ausbond Composite Bond index, a broadmarket fixed rate bond index, over the first 5 months of 2022. While the Trust is not benchmarked against the Ausbond Composite, the performance differential is useful to highlight what exceptional defensive characteristics floating rate credit continues to deliver in conditions hallmarked by rampant inflation and monetary policy tightening.

PCI NTA vs Bloomberg Ausbond Composite

Source: Perpetual & FactSet. Daily Net Tangible Asset (NTA) is available at (VIEW LINK). All figures are in Australian dollars (AUD), unless otherwise stated. All figures are unaudited and approximate. Past performance is not indicative of future performance. NTA figures are calculated as at the end of day on the last business day of the month.

Whilst it is tempting to think that the best that floating rate credit has to offer has now past, the drivers of recent volatility in fixed rate bonds persist. We believe that investors considering reallocating to fixed rate should bear in mind;

- Credit spreads have already expanded a fair degree, offering higher income for investors and while the outlook is challenging further spread expansion offers attractive entry points offering competitive yields. Income remains the core component of portfolio return for floating rate strategies. Throughout the recent volatility, PCI has substantially mitigated and often completely offset the impact of widening spreads as a result of the Trust portfolio’s robust running yield. The current market conditions continue to facilitate this with rising short end swap rates and credit spread expansion.

- Despite the significant selloff in yields over recent months, fixed rate bonds are not cheap relative to historical levels. While at current levels, the payoffs are no longer asymmetric, there still remains significant downside risks. Inflation remains stubbornly high and geopolitical and supply chain factors continue to heap pressure on CPIs. Actively managed, value and quality focused floating rate credit aims to provide capital preservation through an aggressive rate cycle while also managing credit risks to better weather a potential recession arising from a hard landing.

- At the same time, floating rate credit is less sensitive to implementation and policy error risks arising from the RBA’s tightening cycle. As seen over the last two meetings, the RBA retains the ability to surprise rates markets which has been a catalyst for yields rising sharply and increased rate volatility. To this point in the tightening cycle, the selloff in fixed rate bonds has been predominantly driven by shifting monetary policy expectations rather than execution. There is still a long way to go before inflation is under control, during which time floating rate assets are better insulated from the impact of implementation risks or policy errors.

It is worth noting that being a listed investment trust, PCI’s return profile exhibits some equity characteristics. Over recent months, persistent high inflation, accelerated monetary policy tightening and increased geopolitical risks have weighed on equity markets. The dichotomy between the risk appetite in equity markets and the resilience of floating rate credit can be observed in the current discount to NTA. With rising yields, rate volatility and expanding spreads expected to offer a plethora of relative value opportunities in the floating rate space, the current discount offers an attractive buying opportunity for PCI.